AVENUES OF INVESTING for INDIAN NRIs living in JAPAN – A Basic primer

AVENUES OF INVESTING for INDIAN NRIs living in JAPAN – The Basics

- by a SEBI Registered Investment Advisor (contact details below if you need more assistance)

Are you someone who wants to earn the income of the developed world but want your investments to witness the growth of the developing world?

Then this is the article you should read to make sound investment decisions with your hard-earned money.

When it comes to investing your money, you have a unique vantage point as an Indian NRI in Japan. Japan itself being a developed country and the 3rd largest economy in the world, has several good investment options. As residents/citizens of Japan, you also have easy access to other developed markets like United States or Singapore or even Hong Kong.

But, as very aptly illustrated in the best-selling book “Paradox of Choice” by Barry Schwartz, sometimes too much choice is counter-productive. The human brain gets over-loaded with too much information and then finds it difficult to make a good choice.

When such a situation arises, to make a good decision one can take refuge in the old adage – “Always go back to basics.”

Let me lay out the options that you have to invest your money.

If you think a little bit about this, you will realize that all investment products basically boil down to these four types:

1. Fixed Deposits

They are the easiest and the safest forms of investment and a great way to preserve your savings and create a contingency fund.

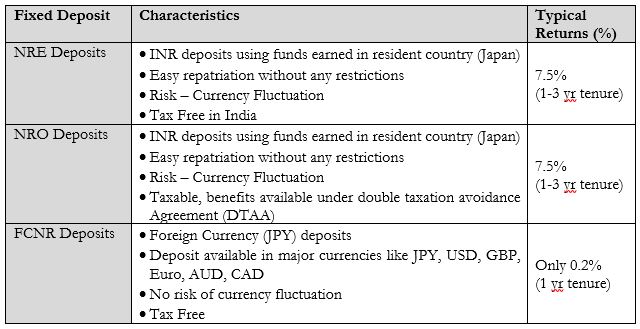

Some avenues for investing in Fixed Deposits for NRIs include NRE/NRO/FCNR Deposits.

I am sure all of you would have heard about these deposits; what is the difference between them?

However, JPY FCNR deposits are hardly an improvement over the fixed deposits made in SMBC trust bank in Japan.

A government of India Bonds – This is another option similar to Fixed Deposits with the only subtle difference that you are lending your money to the government instead of the bank. The 10-yr GOI bond will yield about 7.5%. However, GOI bonds is a double-edged sword because the price of the bond (principal) goes UP or DOWN depending on whether interest rates in India reduce or increase. This might be an unacceptable risk for many retail investors, though investing through debt mutual funds specializing in Government Securities is a good option.

2. Gold

Gold is a great store of value and is accepted all over the world, but it does not beat inflation. In my opinion, gold’s better utilization is enjoyment – make as much jewelry as your spouse/daughter/mother (in-law) wants. Let them enjoy.

3. Real Estate

Real Estate is a hard asset which most of us are aware of, comfortable with and feel safe investing in. Real Estate prices tend to increase over a period of time and it can also be used as collateral with a bank in case of requirement of loans eg. Education loan for your kids etc.

Real estate also tends to beat inflation over a period of time.

The real estate sector as a whole has become far more transparent and professional over the last 10 years especially so after Demonetisation in Nov-16 and passage of RERA bill in Parliament in 2017.

Real estate prices have not increased fast enough in the last 5 years, however the fact remains that India is a rapidly urbanizing country with the average wealth of and Indian rapidly increasing. This will remain a good investment avenue especially of your time horizon is more than 10 years.

4. Stocks/Mutual Funds

Japanese stock markets have been the nemesis of stock market investing since the crash in 1991.

In fact, the Japanese stock market index Nikkei 225 has not gone anywhere in the last 28 years.

However, the Indian economy has seen rapid growth since the 1991 liberalization and so has the Indian stock market.

The benchmark index – SENSEX has gone up a staggering 40 times since 1990

However, just as fortunes can be made in stocks, fortunes can also be lost in stocks.

For those amongst us who don’t have the required time or the skills to analyze individual stocks, there is a good alternative – hire a competent professional money manager.

India has more than 20 mutual fund companies (asset management companies) registered with the market regulator SEBI and most have been in operation for more than a decade.

For most people, mutual funds is a very good way of getting an exposure to the Indian stock market.

Now let us briefly discuss what are the things that you need to take care before investing in India.

• Currency Fluctuation Risk

This is the risk which is most out of control of the investor. Currency markets have their own peculiar behavior and one has to almost always live with the consequences.

However, over long periods of time, the change in the currency conversion ratio tends to emulate the difference in the inflation trajectory in the two host countries.

1 JPY could buy 0.53 INR in 2008 whereas today in 2018, it can buy Rs 0.63 INR.

Factor in a 2-3% depreciation in the Indian Rupee over your investment time horizon.

Currency fluctuation is a risk if you intend to take back your invested money to Japan. For people who plan to eventually retire and come back to India or those who keep most of their investments in INR, this is a non-existent risk.

• Compliance and paperwork

Indian authorities and regulators are skeptical about all foreign currency that comes into India. The rules are very strict and compliances are cumbersome. Always make sure that you fulfill all the regulatory requirements of Indian authorities when you invest in India, be it Fixed Deposits, stocks or real estate.

• Tax Treatment

India and Japan have signed a Double Taxation Avoidance Agreement way back in 1989.

Though the rules are clear and time-tested, compliance and proper paperwork is a must. Hire the services of a competent Chartered Accountant who has experience in such matters.

To illustrate, interest income earned out of Fixed Deposits in NRE accounts is tax exempt in India, but the income will have to be declared in Japan and due income tax be paid.

Capital Gains taxes arising from the sale of stocks listed in India has to be paid in India.

No discussion about investing in complete without discussing bitcoin and cryptocurrencies. Blockchain is a revolutionary technology that is changing a lot of things that have been taken for granted in the world of finance. Bitcoin has revolutionized the way international payments are settled. Ethereum is changing the way contracts executed amongst counter-parties.

However, cryptocurrency is not an investment asset class. One must know why prices for an asset class go up or down and there is no other explanation to bitcoin/cryptocurrency prices fluctuating other than popularity or the lack of it amongst the investors.

Your hard-earned money required consistently predictable investment avenues, one can leave the speculative avenues to the recklessly adventurous types.

Do let us know how you liked the post and also comment below if you want to know more about specific investment options.

Amey Kulkarni

amey.kulkarni@candorinvesting.com

SEBI Registered Investment Advisor

Registration No – INA000010654

Leave a Reply to IndoJapanPulse

Please look at footer of website for Disclaimer and Privacy Policy.